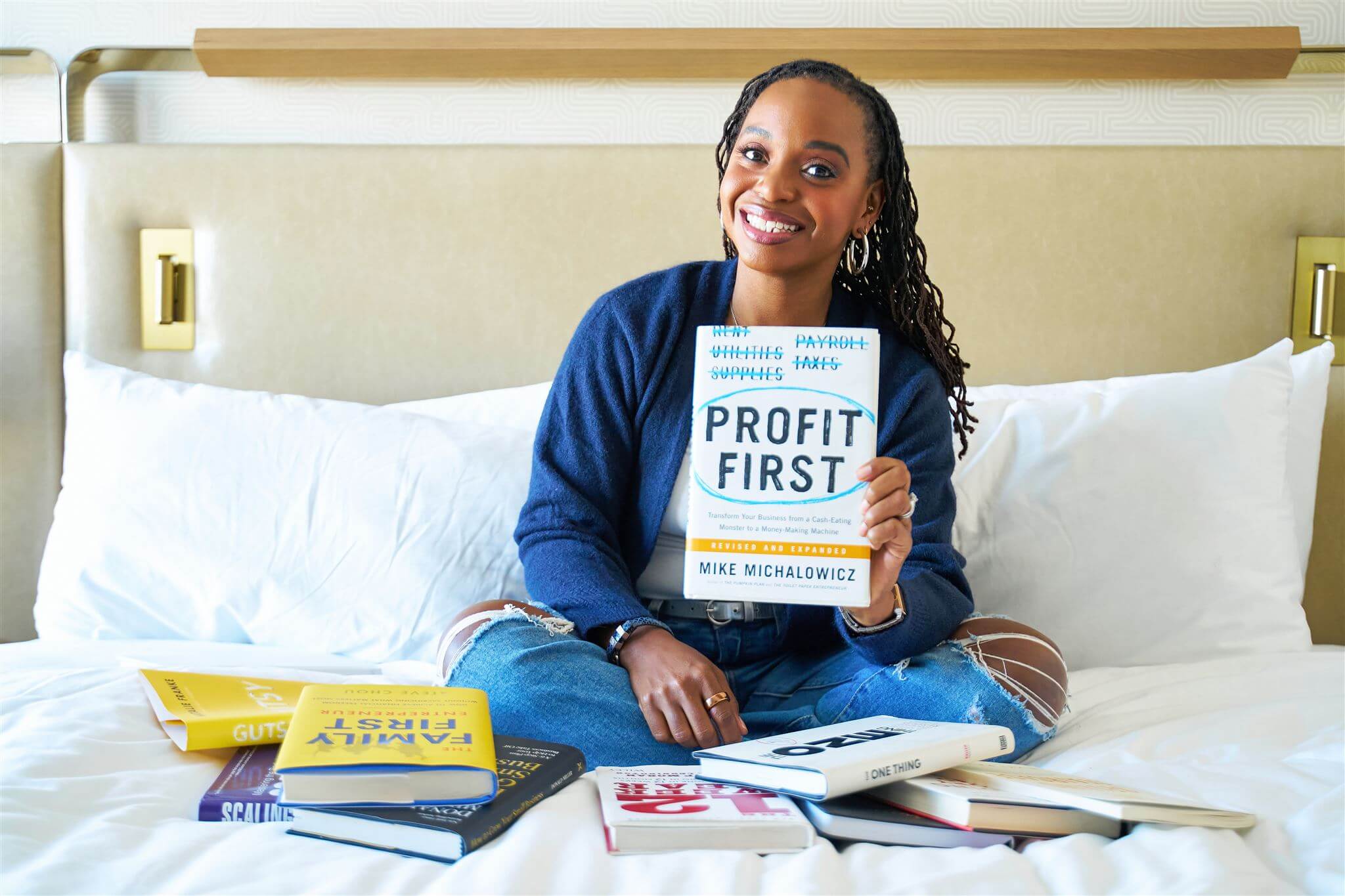

In the world of business, the bottom line matters. But what if I told you that profitability could be more than just a goal – it could be a guiding principle that transforms the way you manage your finances? Enter Mike Michalowicz’s book, Profit First– a revolutionary approach to business finances that prioritizes profitability from the outset. Let’s delve into the principles and explore how it can revolutionize your business.

Understanding Profit First

At its core, it is a cash management system that flips the traditional approach to finances on its head. Instead of waiting until the end of the year to see if there’s any profit left over, Profit First advocates for allocating profit from every revenue dollar first, ensuring that profitability is baked into the DNA of your business from day one.

The Four Core Principles

There are four core principles: 1) Allocate profits first, 2) Use small plates, 3) Remove temptation, and 4) Enforce rhythm. By following these principles, businesses can establish healthy financial habits, build reserves for profit and taxes, and maintain a clear understanding of their financial health at all times.

Implementing Profit First in Your Business

Implementing this model starts with assessing your current financial situation and establishing target percentages for profit, owner’s compensation, taxes, and operating expenses. By setting aside profit and other allocations from each revenue deposit, businesses ensure that they prioritize profitability and financial stability, even in times of uncertainty.

Benefits of Profit First

The benefits of adopting the principles are manifold. By prioritizing profitability, businesses gain clarity and control over their finances. They reduce financial stress and build reserves for growth and expansion. It also fosters a culture of financial discipline and accountability, empowering business owners to make informed decisions and drive sustainable long-term success.

Overcoming Challenges and Staying Committed

While the principles of Profit First may seem simple in theory, implementing them in practice can be challenging. It requires discipline, consistency, and a willingness to break old habits. However, by staying committed to the process and seeking support when needed, businesses can overcome challenges and reap the rewards of a profitable and sustainable financial future.

In an increasingly competitive business landscape, profitability is not just a luxury – it’s a necessity. By embracing Profit First, businesses can transform their finances, prioritize profitability, and build a foundation for long-term prosperity. Whether you’re a startup looking to establish healthy financial habits or an established enterprise seeking to reignite growth, this model offers a roadmap to financial freedom and empowerment.

Want to know some of my other favorite business books? Check them out here!

Comments +